By discounting 10% off, you might be giving half of your profits away.

Or you need to sell twice as much to make up for lost profit.

For most brands, a 10% discount can lower profits by 33% to 70%.

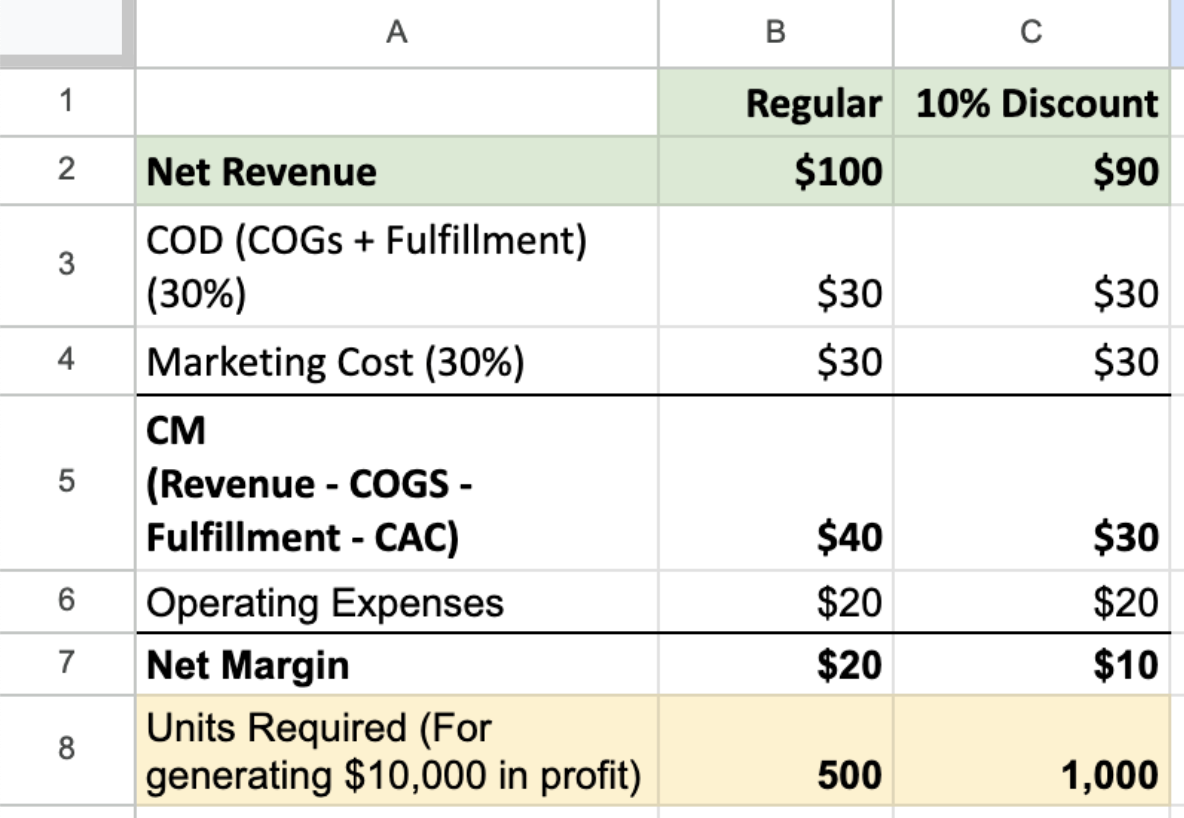

In this example, for $100 in revenue,

Marketing (30%) – $30

COD (COGs + Shipping + Payment) – $30

OpEx (20%) – $20

Net Profit – $20

Now with a 10% discount

Keeping everything the same, the net profit comes down to $10.

To generate profits of $10,000, we need to sell 1,000 units compared to 500 units.

As discounting directly eats up the revenue, keeping all the costs the same, it can seriously impact profits.

The only positive impact is the reduction of marketing costs, which is also nullified by an increase in OpEx.

Also, in this case, marketing costs need to go down by 33% to justify a 10% revenue loss, which doesn’t happen.

I am not against discounting.

Brands can really use discounting to increase their average order value and conversion rate.

I have written about it over here.

The problem is not realizing the impact of it on the bottom line.

The solution is to run smart discounting.

- Targeted offers for each customer segment

- Discount on minimum purchase to increase AOV

- Discount on selected inventory

- Running short sales to create urgency

In short, to get all the benefits of discounting without getting burnt.

Most importantly, accounting for discounts and see their impact on the bottom line.