Growth with profitability. That’s the ultimate dream for any business.

What more do you want?

You are making profits. And growing your business. And you have cash. (the ultimate 3 metrics)

But it’s not as simple as starting a company.

Scaling profitability shows,

You have a product-market fit.

You have a channel fit.

You have a customer fit.

You have a pricing fit.

You have a cash flow fit.

Till you have all above, you will not be able to scale profitably.

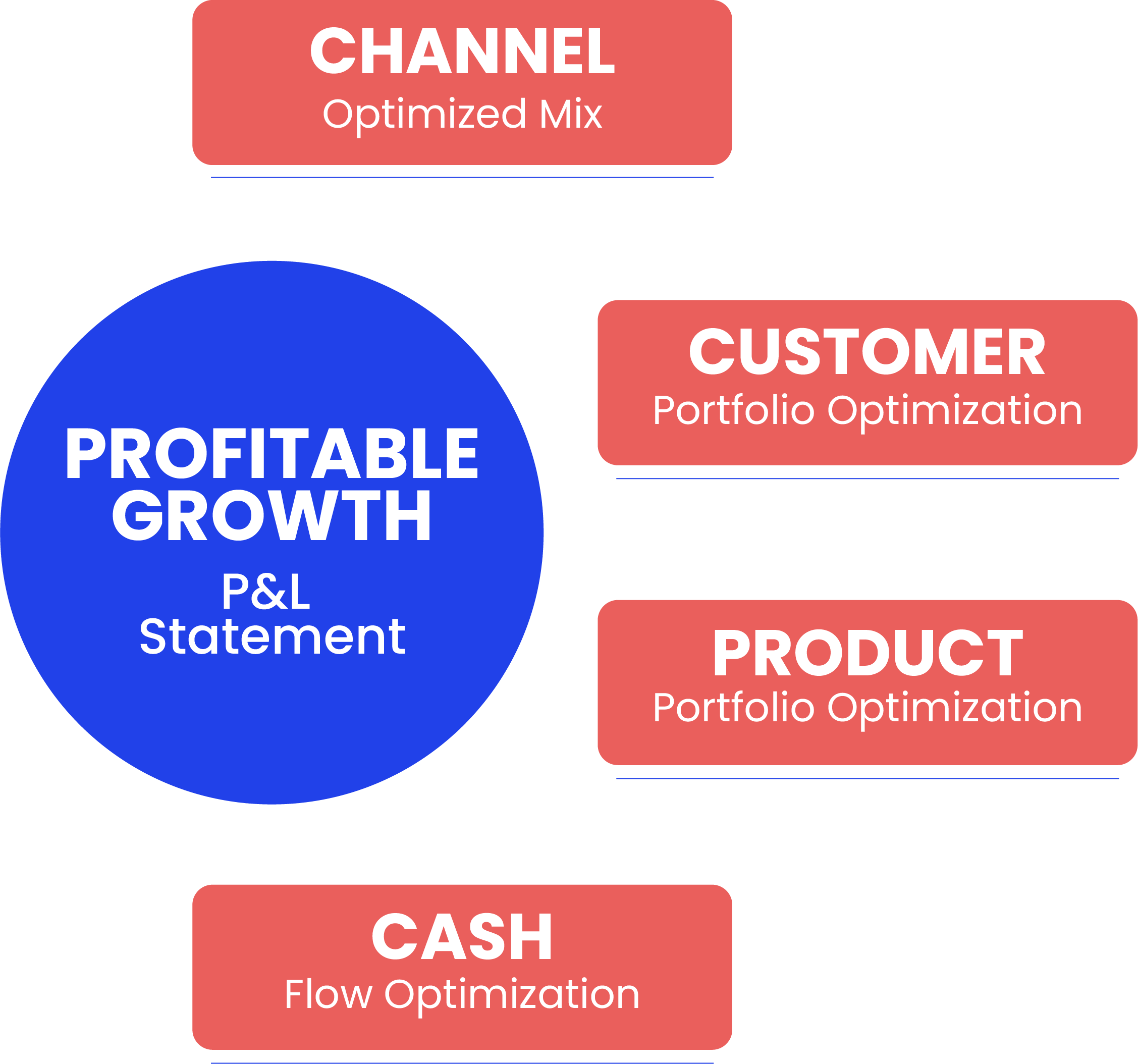

Now after being in ecommerce for 15 years, both running my brand and scaling other ecommerce brands, I have developed a 4C framework.

4C – Catalog, Customer, Channel & Channel framework to scale businesses profitably.

Before understanding why you need a different paradigm to scale your company, you need to understand the reasons.

Why profitability is tough in ecommerce?

After talking to 100+ founders, there are 6 key reasons for unprofitability.

These are the most common ones –

- High Customer Acquisition Costs

- Low Retention Rates

- Low Product Margins

- Complex and Expensive Fulfillment Costs

- Poor Understanding Of Financials & Cash Flow

- Rising Fixed Costs

High Customer Acquisition Costs (CAC)

Possible causes for high acquisition costs –

- Highly competitive market. Too many clones or similar products.

- Inefficient Product-Market Fit (More like a signal of issue, rather than the solution)

- Lack of differentiation in the market. Change of customer preferences, taste, etc.

- Ran out of new users to acquire. Limited by your Total Addressable Market (TAM)

- Higher budgets increase the average cost of acquisition. Most brands want to grow at an unreasonable pace.

- You can grow to a certain point without losing money. If you try to grow too fast too soon, you end up making losses as profits from existing customers don’t come as fast to offset the loss from the acquisition.

- You make less money on the customer than it costs them to acquire them.

Possible solutions for reducing your acquisition costs –

- Maximize customer lifetime value

- Optimize Targeting and Ad Spend – New creatives

- Improve Conversion Rate Optimization (CRO) – Better landing pages and checkout experience

- Look for cheap acquisition channels – Organic, WOM – Referral

- Avoid competing on price alone, without unique selling propositions (USPs).

- Niche positioning to avoid commoditization/competition.

Low Retention Rates

Possible causes for low retention rates –

- Bad product quality. Not fulfilling the intended promise, or working as promised

- It’s a one-time-use product. Or, customers might not buy the same product again.

- Lack of value for money. Failing to create perceived value around the product.

- Bad order experience with delivery issues, returns process, or lack of customer support.

- Weak post-purchase communication – No help guide/cross-sells or win-backs.

- Lack of moat for loyal customers (Membership, Subscription, Loyalty Program).

- Lack of emotional connection with brand – Branding / Community / Cause.

Possible solutions to increase your retention rates –

- Build an emotional connection with the brand – Branding / Community

- Build a moat around your loyal customers (Either membership / Subscription / Loyalty program)

- Strong post-purchase communication channels (Email / SMS). Personalization, segmentation, and predictive analytics.

- Monitor Ops Issues (KPIs)

- Focus on hero products that bring profitability and loyalty.

Low Product Margins

Possible causes for low product margins

- Wrong pricing model – Not building discounting inside the products.

- Low selling price – prices are not optimized and tested regularly.

- Training customers to buy in sales.

- Wrong sourcing or product.

Possible solutions to improve your margins –

- Use data-driven decisions to eliminate underperforming SKUs.

- Building discounts inside your product prices.

- New arrivals and clearance cycle to keep rotating products.

- Use bundles or high ticket discounts.

- Give targeted discounts to each customer profile instead of a bulk discount.

Complex and Expensive Fulfillment Costs

Possible causes for high fulfillment costs –

- Shipping partners and logistics structure.

- Wrong inventory forecasting.

- Supply chain disruptions – Dependency on single suppliers

- Too many SKUs lead to inventory management issues.

- Complex international regulations (taxes, tariffs, data privacy, etc.).

- Erratic demand spikes – Managing peak shopping seasons (BFCM, Summer).

- High return rates in some niches (fashion)

Possible solutions to improve your fulfillment costs –

- Remove low-volume, high-return products. Focus on fewer products.

- Better inventory management and forecasting.

- Diversify suppliers

- Better return management

Poor Understanding Of Financials & Cash Flow

Possible causes for poor understanding of financials and cash flows

- Lack of understanding of key financial metrics.

- Relying on average metrics that mask problems.

- Inefficient marketing attribution to manage and forecast budgets.

- Looking to grow numbers just by acquisition and not letting retention compound.

- Short-term growth vs long-term profitability

- Dependence on third-party platforms (Causing low margins and high unpredictability)

- Focusing on profit margins vs profit dollars

Possible solutions to solve cash flow issues and have a better financial understanding –

- A better understanding of unit economics and drive decision-making from there.

- Have a clear roadmap to profits, accounting for the budget/targets for each section of the business.

- Breaking up costs by channels, customers, and products to analyze & allocate performance

Rising Fixed Costs

Possible causes of rising fixed costs –

- Team structure

- Expensive hires instead of the core team.

- Bloated software stack for the business (marketing, ops)

- Outsourced vs in-house team structure

Possible solutions to reduce fixed costs –

- Rely on the core team instead of expensive hires

- Keep the costs variable

- Work within the unit margins to keep the costs down.

To achieve profitable growth, we need a core mindset change.

Profitable Growth CEO’s 10 Rules

1. Need to do a profitable, consistent acquisition.

Stop acquisition when it starts hurting profitability.

Don’t aim to grow at an unreasonable pace.

Look for new channels to get cheaper acquisitions.

2. Look at existing customers for growth.

Need retention to compound, so over time existing customers should be able to generate enough profits to drive further acquisitions.

Need to monitor and reactivate existing customers.

Create a moat around your loyal customers.

Every brand needs predictable revenue from its existing customers.

3. Aim for first order profitability or 60 days LTV breakeven

Focus on making a profit on the first purchase itself.

Focus on profit per customer and profit per product sold.

By looking and analyzing your unit economics, work within your margins to target first-order profitability

Remove unprofitable products or channels from your marketing mix. Try to increase the average order value.

4. Maximize profit and not margins.

Focus on contribution margin to maximize profits.

Once you start scaling, you can lose your margin to maximize profit dollars.

5. Invest in building emotional loyalty

Branding goes a long way to improve profitability.

No wonder the biggest brands in the world are highly profitable.

Build a personality, values, and emotional connection with your audience. Either by branding, community, or values.

6. Focus on fewer SKUs

Focus on hero products that bring profitability and loyalty.

Many companies have generated millions by selling a single SKU.

You don’t need multiple SKUs.

Instead focus on variations, colors, and tweaks.

7. Better inventory – marketing sync

Inventory and marketing need to be in sync with planning, forecasting, and clearance.

Inventory can lead to high capital costs, so it’s important to have an agile supply chain that directly links with marketing.

8. Increase credit cycle to improve cashflows

Increase credit cycles with your suppliers to fund the growth.

Even 1-2% interest on a 90-day credit cycle is better than restricting cash flows.

Get longer term for payment with your partners.

9. Change and keep on experimenting with pricing and discounts

Plan pricing to include discounting/deals/offers to generate sales.

Ecommerce is a discount-driven sales model.

Focus on maximizing profits

10. Build only the core team on fixed costs

Focus on building your core team to handle each department.

Keep the rest of the costs down with minimal fixed costs.

4C Framework