In the dynamic world of ecommerce, success hinges on the ability to balance various factors while ensuring sustainable growth and profitability.

Meet the not-so-secret ratio – LTV/CAC.

Dive in, it’s time we rethink retention!

Among these factors, the Lifetime Value to Customer Acquisition Cost (LTV/CAC) ratio plays a pivotal role.

In this article, we will cover:

- The concept of LTV CAC Ratio (both good & bad ratio)

- Importance of LTV CAC Ratio for ecommerce brands.

- How to measure Customer Acquisition Cost (CAC).

- How to measure Customer Lifetime Value (LTV).

- How to calculate Average Order Value (AOV).

- How to calculate purchase frequency.

- 3 essential tips for a healthy LTV CAC Ratio.

The LTV CAC Ratio: A Balancing Act

The LTV/CAC ratio is a fundamental metric that measures the relationship between the value a customer brings to your business over their lifetime and the cost incurred to acquire that customer.

This ratio is like the compass for e-commerce brands, guiding them toward profit or peril.

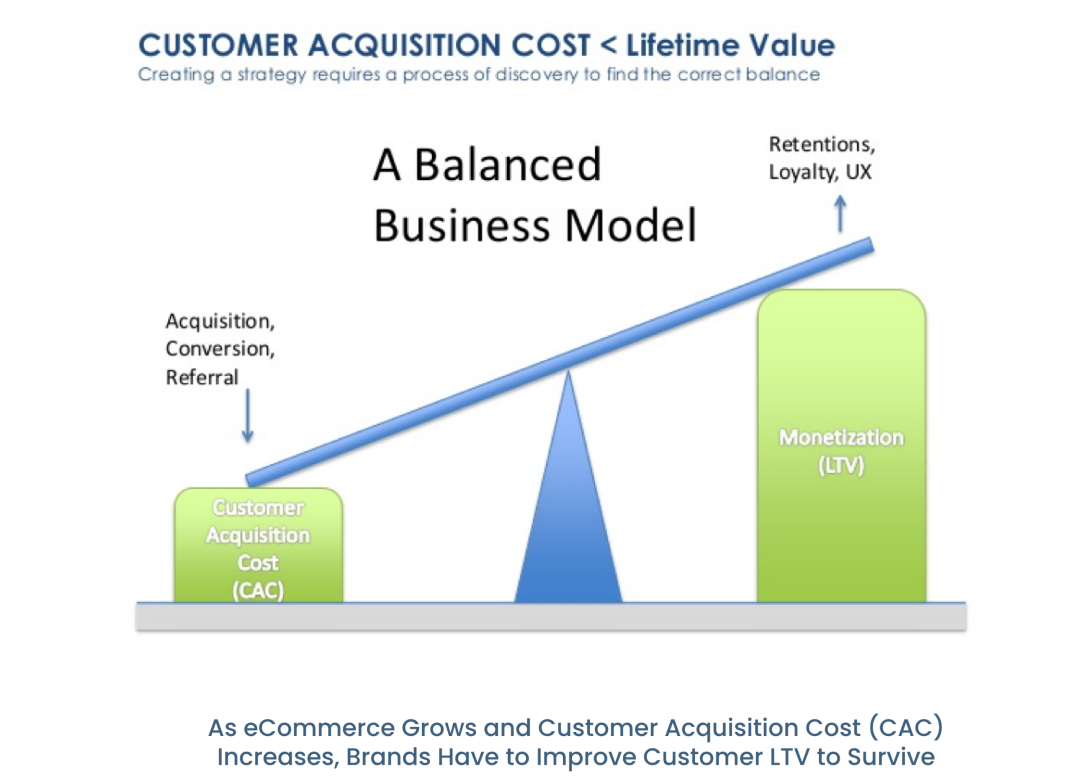

Favorable LTV CAC Ratio aka “A Balanced Business Model”

A good LTV CAC ratio generally falls within the range of 3:1 to 5:1.

In this scenario, for every dollar spent on acquiring a customer, you can expect to generate $3 to $5 in revenue over the customer’s lifetime.

A higher ratio implies more significant profitability and the ability to scale with confidence.

Let’s consider an example:

Imagine an e-commerce brand, XYZ Watches, spends $100 to acquire a customer. On average, a customer generates $400 in revenue over their lifetime.

The LTV CAC ratio here is 4:1, which is considered healthy. For every $1 invested in acquiring a customer, XYZ Watches earns $4.

,

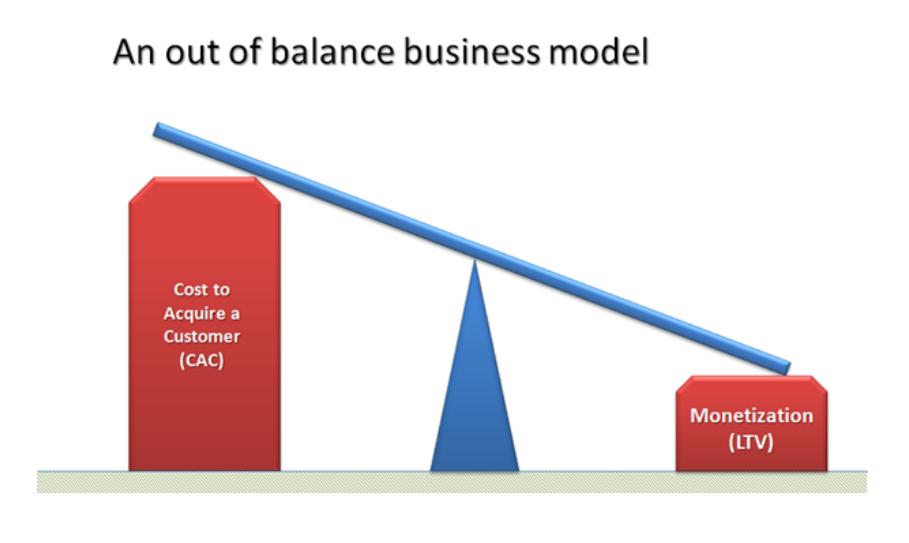

Unfavorable LTV CAC Ratio aka “An Out of Balance Business Model”

Conversely, a poor LTV CAC ratio falls below 1:1.

This indicates that the cost of customer acquisition is higher than the revenue generated from that customer, spelling potential trouble for the business.

For example, if another e-commerce brand, ABC Electronics, invests $150 in acquiring a customer, but that customer only generates $100 in revenue throughout their lifetime, the LTV CAC ratio is 0.67:1.

This is an alarming sign, as it implies that the business is losing money for every customer acquired.

The Significance of LTV CAC for E-commerce Brands

Understanding and monitoring the LTV CAC ratio is crucial for e-commerce brands for several reasons:

1. Profitability Assessment

The LTV CAC ratio serves as a key indicator of your business’s profitability. It helps you determine whether you are spending an appropriate amount on acquiring customers and if your customers are valuable enough to sustain the cost.

2. Scaling Decisions

A healthy LTV CAC ratio is essential for scaling your e-commerce business. It provides the confidence to invest in customer acquisition channels, knowing that the investment will yield a positive return.

3. Customer Segmentation

By calculating LTV CAC for different customer segments, e-commerce brands can identify their most valuable customers and tailor marketing strategies accordingly. This enables a more efficient allocation of resources.

How To Measure Customer Acquisition Cost (CAC)

Measuring CAC involves calculating the total cost incurred to acquire a customer.

The formula is straightforward:

If you wish to go with the easiest formula-

CAC= Total Marketing Budget (Month) / Total Unique New Customers (In a Month)

But If you wish to follow the correct formula-

CAC = Total Marketing Budget Allocated To Acquiring New Customers / Total Unique New Customers

Let’s illustrate this with an example:

Suppose a company spends $10,000 on marketing and sales efforts in a month and acquires 500 customers during that period. Using the formula, the CAC is:

CAC = $10,000 / 500 = $20 per customer

This means the company spent $20 on average to acquire each customer during that month.

How To Measure Customer Lifetime Value (LTV)

LTV represents the total revenue a customer generates for your business over their lifetime.

To calculate LTV, you can use the following formula:

LTV = Average Order Value x Repeat Purchase Frequency x (6 months)

Let’s break this down with an example:

- Average Order Value (AOV)- AOV is the average amount a customer spends on a single purchase. Suppose the AOV for a particular e-commerce brand is $50.

- Purchase Frequency- Purchase frequency denotes how often a customer makes a purchase within a specific timeframe. Let’s say, on average, customers shop from the brand four times a year.

- Customer Lifespan- The customer lifespan is the average number of years a customer remains active with the brand. Most businesses track this over time, which could be 2-3 years or more.

However, I strongly advise against this for small businesses because most can’t afford to invest for a 3-4 year payoff.

You want your customer investment to be repaid in 6 months to a year at most. Anything on top of that is icing on the cake, but not part of the strategy.

Now, we can calculate LTV:

LTV = $50 (AOV) x 4 (Purchase Frequency) x 6/12 (Customer Lifespan) = $100

So, the LTV for this brand’s customers is $100.

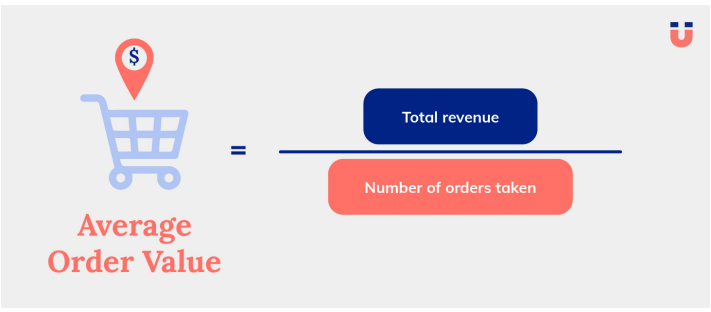

Calculating Average Order Value (AOV)

AOV is a simple but vital metric that represents the average value of each transaction.

The formula to calculate AOV is:

AOV = Total Revenue / Number of Orders

For instance, if an e-commerce brand earned $50,000 in revenue from 1,000 orders in a month, the AOV would be:

AOV = $50,000 / 1,000 = $50 per order

This indicates that, on average, customers spend $50 in each transaction.

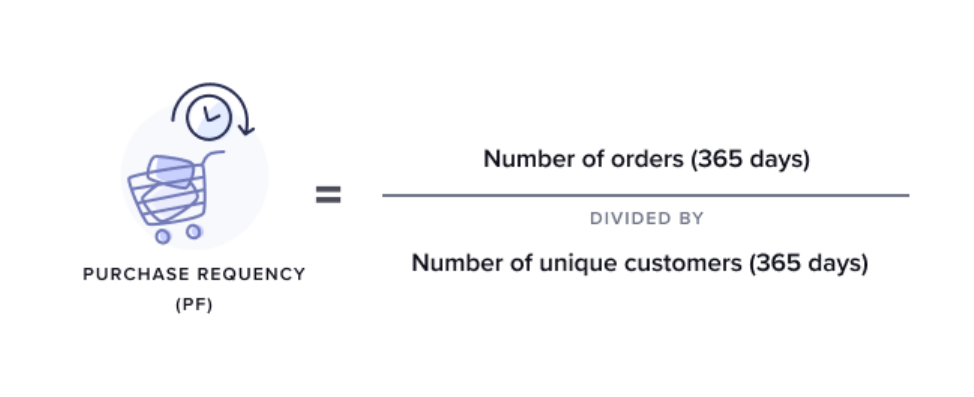

Calculating Purchase Frequency

Purchase frequency signifies how often a customer returns to make a purchase within a specified time frame.

To calculate this, use the following formula:

Purchase Frequency = Total Number of Orders in last 365 days / Number of Unique Customers

Suppose an e-commerce brand had 5,000 total orders in a year, and 1,000 unique customers made those orders. The purchase frequency would be:

Purchase Frequency = 5,000 (Total Orders) / 1,000 (Unique Customers) = 5

This means that, on average, each customer made 5 purchases within a year.

Also, Shopify store owners can also find this data in their reports under sales by customer.

3 Essential Tips for a Healthy LTV CAC Ratio

#1 Segmentation is Key

Analyze your customer base to identify segments with varying LTV CAC ratios. Focus your marketing efforts on the most profitable segments and consider reducing spending on those with lower ratios.

This targeted approach can significantly improve your overall LTV CAC ratio.

#2 Retention Matters

Increasing the customer lifespan, purchase frequency, and average order value can positively impact your LTV.

Implement retention strategies such as loyalty programs, personalized recommendations, and exceptional customer service to keep customers engaged and coming back for more.

#3 Keep an Eye on Metrics

Regularly monitor and reassess your LTV CAC ratio. Market dynamics, customer behavior, and competitive landscapes change, so staying vigilant will help you adapt to new challenges and opportunities as they arise.

Conclusion

The LTV CAC ratio is a guiding star for ecommerce brands, providing insight into the financial health of their customer acquisition efforts.

A good LTV CAC ratio signifies a profitable and scalable business, while an unfavorable one can indicate financial trouble.

By understanding the components of the ratio and following the 3 essential tips, e-commerce brands can navigate the complex terrain of online commerce with confidence, ultimately driving sustainable growth and success.